Are we on the edge of a second house price crash?

The big question after today’s release of the Halifax house price index is whether the market is heading for a protracted decline or whether prices will stabilise and hold or continue to creep up from the trough of a year or so ago.

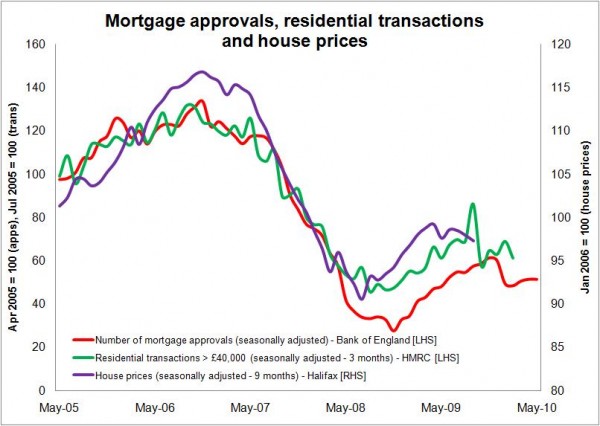

It must be said that today’s figures, which show the third in a straight set of monthly declines, fit the pattern expected given the recent movement in what might be regarded as leading indicators for house prices.

We have seen weak mortgage approval and property transaction figures and the surveyors’ body RICS and others have been recording an increase in houses coming on the market at a time when the numbers of buyers is flagging.

We have seen weak mortgage approval and property transaction figures and the surveyors’ body RICS and others have been recording an increase in houses coming on the market at a time when the numbers of buyers is flagging.

As the graph (right) that I have been plotting for a few months shows the latest set of Halifax figures is consistent with the drop in mortgage approvals and transactions – that is assuming the apparent correlation we see in the sets of figures are more than coincidental.

The question is: where to from here?

The optimistic interpretation of the figures is that the flattening and slight decline in house price inflation is temporary and results from the unsettling effects of the General Election, the abandoning of HIPs and the uncertainties on policy now the new coalition government is bedding in.

Maybe there is something in that.

And there will also be those who point to the trickiness of buyers obtaining mortgages restricting the number of potential buyers.

But to get this in proportion the problem of raising a big deposit tends, in the main, to hit first time buyers which currently account for just over a third of new mortgages, according to the Council of Mortgage Lenders. So the majority of buyers are likely to be less inhibited by the tougher lending regime.

Against this though prices did plunge and the cost of servicing a loan drastically fell which would have made it easier for many first time buyers to afford a home, if they could stump up the down payment. It is worth noting the proportion of first time buyers among those taking out home purchase loans rose as house prices fell.

And at the fringes of the arguments on the optimists side we should expect large amounts of ill-informed guff that, intentionally or otherwise, links short-term price movements to shortages in the overall stock of housing.

The pessimists probably have a few more shots they can fire.

The first must be that house prices remain exceptionally high by any historic comparison, if you leave aside the peak of the boom that ended with the credit crunch.

They would argue that it was only low interest rates and more sympathetic handling by lenders of potential repossessions that bailed out the market and headed off a savage cull of homeowners. Interest rates are unlikely to stay at the lowest level for 300 and some years for that much longer.

It is worth noting that the Halifax press release says that the average mortgage rate paid by existing borrowers is 2.13% less than in April 2010.

Given that a 1% drop in mortgage payments puts more than £10 billion annual into the pockets of home owners, homeowners on aggregate are more than £20 billion a year better off. That is about twice the impact of the fiscal stimulus produced by the cut in VAT.

Imagine that reversing and £20 billion taken out of the pockets of house builders. Indeed it is worth noting that simply the ending of this stimulus effect itself will impact to decelerate demand as any surge created by the stimulus fades.

The pessimists would also argue that unemployment was less than expected given the drop in national output as employers took a more sympathetic view and employee showed more flexibility in the face of the recession.

This suggests a degree of “hidden” unemployment or increased underemployment which would suggest that recovery is unlikely to prompt firms to take on new staff ahead of rebuilding full-time working. This might mean a slower growth in employment than historically would have been the case.

In contrast to the response of the private sector to the recession, the swathe of public sector layoffs in the pipeline is likely to be fairly swift and pretty brutal.

The net effect, pessimists would argue, is that a fairly sharp rise in unemployment is very possible with a potentially nasty impact on the housing market. This I must add is not the view of the Office for Budget Responsibility or the Government.

Meanwhile for those folk in work earnings are set to be squeezed.

Wherever one falls on the pessimist-optimist spectrum there are plenty more arguments that could be made for and against a fall or rise in house prices.

But on balance it does seem to me on the balance of current evidence that if you want a punt on which way house prices will head from here, the data does point more to a wager on a price fall for this year.

But as for a house price crash – say a double-digit annual fall in prices – I suspect that would need something rather more precipitate than a squeeze on earnings or a modest rise in unemployment, such as a rapid climb in unemployment, a further stiff tightening of credit or a sharp rise in interest rates.

Sadly, none of these events is sufficiently distant from certainty to be able sensibly to rule out the possibility of another house price crash. So there remain plenty of reasons to be cautious.