Some comfort for house builders as inflation fears ease

The latest set of inflation figures showing a fall in the headline rate of the CPI index will provide a good degree of comfort to the interest rate setters at the Bank of England’s Monetary Policy Committee.

And in turn this should provide some relief to those house builders who harbour fears about a rise in interest rates.

At 3.4% the headline rate remains well above the 2% target and as such remains unsettling for those who fear that this may lead to inflation becoming more embedded in the economy than might be thought healthy.

But much of the current spike can be in large part attributed to the odd effects caused by changes to VAT which saw headline prices rise far slower a year ago than they otherwise would have. This means that with VAT restored the relative rise from last year is greater than it would have been.

But much of the current spike can be in large part attributed to the odd effects caused by changes to VAT which saw headline prices rise far slower a year ago than they otherwise would have. This means that with VAT restored the relative rise from last year is greater than it would have been.

There are other worries in the inflation pipeline related to producer prices and I personally lean towards a view that inflation may prove more of a problem than many analysts suggest. But the MPC and those more relaxed about inflation will be much comforted by the direction of the index showing CPI excluding any indirect taxes.

The CPI (ex-tax) measure of inflation rose for two consecutive months and rightly this caused a few jitters. But it did fall back in May below the 2% target. A further rise in this measure would have reinforced fears of earlier interest rate rises.

But if this measure holds fairly firm around the target area and there are no substantial changes to indirect taxes, the MPC can then expect more acceptable headline inflation as the base effects disappear early next year.

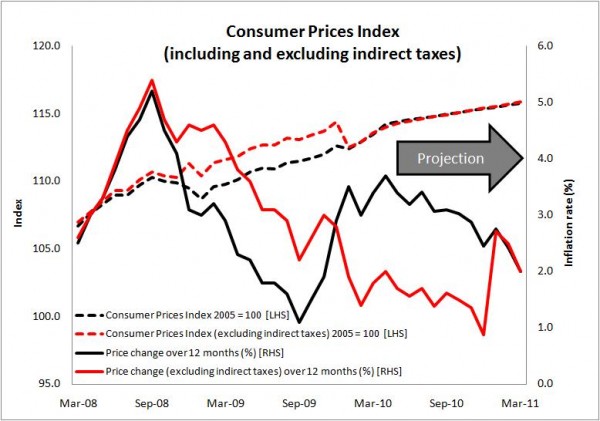

The graph illustrates the weird base effect on the headline figures caused by the VAT changes.

The graph projects forward a steady rate of annual inflation of 2% from May this year to March next year, as seen by the dotted lines measuring the actual index. But the annual rates of CPI and CPI (ex-tax) bounce around a bit before coming into line in the New Year.

But given that average underlying CPI inflation over the past three years has been about 3% there will need to be a significant change in the trend direction if inflation is to be controlled within the target limits.

And with the downward pressure on inflation from imported “disinflation” in the form of ever cheaper consumer goods from the likes of China and outsourced services to India at least in part reversing and with the likely upward pressure from global commodities prices, containing inflation will prove tough.

Add to this a possible increase in VAT, potentially more slack in the economy as spending cuts bear down and increasingly volatile exchange rates and you have to have some sympathy for the members of the MPC as they try to make sense of the direction of inflation.

But today’s figures will provide at least some comfort.