Local builders still deep in recession says latest FMB survey

Evidence that construction is still far from free from the grip of recession has come from the FMB, the trade body that represents many of Britain’s local builders.

The survey results show a market that remained in rapid retreat during the first quarter of this year.

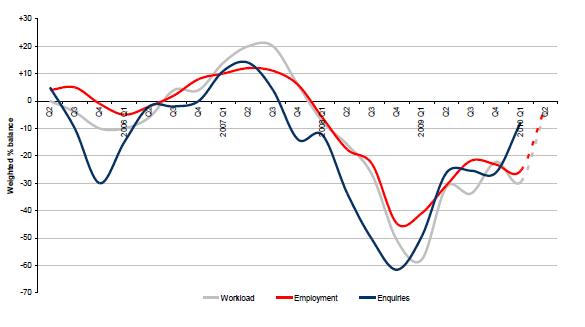

There is some good news as the graph (right) sourced from the FMB survey shows.

There is some good news as the graph (right) sourced from the FMB survey shows.

The level of new inquiries appears to be levelling out and this has sparked some improvement in the level of optimism about both future workload and employment.

But even if the optimism proves realistic, the survey results next quarter will still point to the market for local builders in recession after two and a half years.

The net result of this consistent and deep level of recession is that the level of workload undertaken by the local builders FMB represents will be at very much lower levels than those enjoyed in the earlier parts of 2007.

The one thing that is not clear from this survey is whether or not some of this drop in workload for FMB members results from increased competition.

It is hard to guage how much, if any, of the market previously enjoyed by FMB members has been lost to other businesses, either to more casual operators or to large firms trading into the “local builder” space.

Certainly the pain that has been inflicted on the FMB membership does appear to be far greater than might have been expected given the shape of the recession drawn by the official government data.

It is true that the rapid drop in new housing work will have hit the sector hard. But one of the mainstay sectors for local builders is housing repair and maintenance. This held up very well up to the start of 2009.

Also the non-residential repair and maintenance sector also held up pretty much until the start of 2009. However the FMB survey suggests that workload began drifting south during the middle of 2007.

The data isn’t as finely graded as one might like, but on the face of things the apparent discrepancy between the FMB survey data and the official data does rather point to either glitches in the official data for repair and maintenance work or a structural shift in markets in which the FMB membership operates.

My guess is that it is probably a bit of both.