It’s a double-dip recession for construction, if the statisticians’ first stab at growth is right

Construction has fallen into a double-dip recession – that is if the preliminary estimates by the statisticians putting together the first quarter 2010 gross domestic product figures are to be believed.

The preliminary GDP figures put growth at a pallid 0.2% for the economy as a whole. This low level of growth will be a huge worry for construction if the figure is not revised upward in later estimates.

In fairness the chances of a revision upward in this data does seem reasonably likely given that the figure is built on early returns of data. These early returns would have been disproportionately influenced by the horrid spate of winter weather, which is thought to have knocked economic activity at the start of the year.

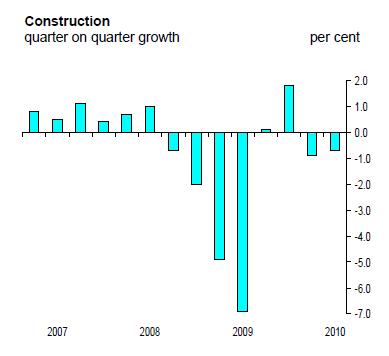

Meanwhile, the statisticians’ first stab at growth for construction saw them record a fall of 0.7% quarter-on-quarter which follows the 0.9% fall in the final quarter of last year (see graph taken from the ONS press release), so technically this would suggest a secondary phase of recession.

Meanwhile, the statisticians’ first stab at growth for construction saw them record a fall of 0.7% quarter-on-quarter which follows the 0.9% fall in the final quarter of last year (see graph taken from the ONS press release), so technically this would suggest a secondary phase of recession.

Interestingly, the first stab made for construction growth last quarter was for no growth – a figure subsequently revised downward to a fall of 0.9% .

So it is probably not wise to put too much hope on upward revisions here.

Most industry number watchers will not be surprised by the fall in output recorded in this set of data, partly because they are modelled estimates, but also because the main forecasters do expect a continued slide in workload this year.

What will interest them more will be the shape of the recovery when more detailed and more accurate survey-based data is released.

They will be hoping for signs of a surge in private sector growth sufficient to create enough new workload to fill the huge and growing hole expected in the pot of public sector funded construction in the next few years.

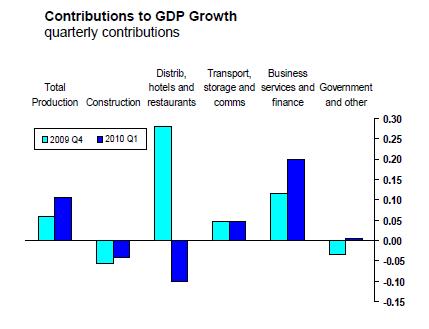

However, the preliminary estimate of GDP is a disappointment given the strength of recovery in some areas of manufacturing, particularly the motor industry, and in business services and finance, where once again bankers are salivating over lavish bonuses (see graph taken from the ONS press release).

However, the preliminary estimate of GDP is a disappointment given the strength of recovery in some areas of manufacturing, particularly the motor industry, and in business services and finance, where once again bankers are salivating over lavish bonuses (see graph taken from the ONS press release).

The fortunes of construction rest heavily on overall growth in the economy to help repair the crippled public finances.

The higher the growth the lower the borrowing and the less the pressure on the public sector’s capital budget, which currently funds about half of all new construction work.

Meanwhile lacklustre growth in the economy overall will reduce the strength of recovery in private sector workloads, which are essential to pull construction from the mire.

So it is fingers crossed until May 25 in the hope that the next release of figures a little more encouraging.