Why falling mortgages approval are spooking housing market watchers

The latest figures from the Bank of England showing the number of mortgage approvals at a nine month low have caused a bit of a stir and increased talk of a double dip in the housing market.

Here’s a few reasons why.

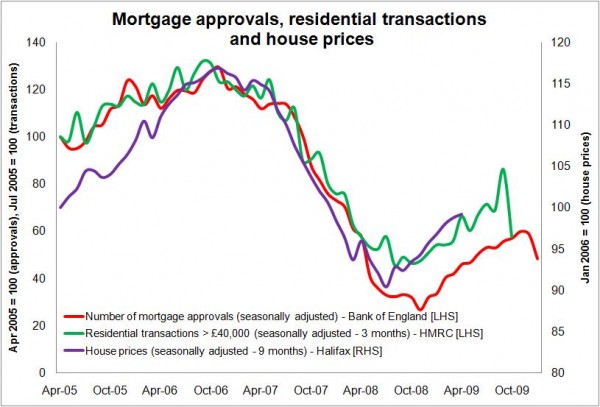

There is a historic link between the number of mortgage approvals and the number of residential housing transactions, as measured by HMRC, and this is clear from the shape of the green and red lines on the graph.

It’s a pretty obvious relationship given that when there are more people looking to buy homes there will be more approvals for mortgages.

There are obviously timing issues here, with approvals being logged before transactions. The best match I can get with the rough and ready approach to putting this graph together is to pull the transactions data to match mortgage approvals data of three months earlier.

It shows a pretty good fit.

So if we see mortgage approvals fall, we should expect to see transactions fall, broadly three months later. So with mortgage approvals dipping away, this looks like bad news for estate agents who thrive of the number of sales and not good news for house builders either, unless they are winning an increased share of the market.

But how does a shift in mortgage approvals link to house prices? Let’s face it that’s the link that interests most of the readers of newspapers.

The causal link is not so clear, other than a crude call to supply and demand.

But if we look at the graph again and the purple line, we can see why analysts might be a bit twitchy about a possible further fall in house prices.

The purple line uses Halifax data and pulls it back to match the mortgage approvals data of nine months earlier (that was the lag that gave the best correlation with the short run of data used here). Also, for emphasis I have changed the scale for the house prices data to exaggerate the rise and fall – basically to make it a bit more sensitive.

On the basis of the lines drawn on the page, one is definitely tempted into the notion that the link is pretty strong. And if you put faith in it and if we don’t see a strong revival in mortgage approvals, you should then expect house prices to start dropping in about six months time.

What’s clouding the call on what these mortgage approvals figures really mean for the market is the set of queering factors such as the recent grotty weather and the ending of the stamp duty holiday.

Is the drop in mortgage approvals down to these factors, or is there an underlying downward trend?

You can see the impact of the stamp duty holiday coming to an end in the residential transactions figures, which show a spike in what is actually the December figure.

And, as if to make things worse for any sensible analysis of the figures, we are running into the General Election, which is another queering factor.

The tricky question for analysts to work out is, when these oddities have passed through the system, will the trend be up or down.

Here you have the usual array of bulls and bears to choose from. But those putting money on the outcome and trading on future house prices, when last I looked, were banking on a slow upward path over the next few years.

But there is one factor that I feel might deserve more consideration (the more eagle-eyed would have spotted this in the graph) and that is the level of cash buyers in the market.

We see the separation of the red and green lines in early 2008 – this will in large part be down to a smaller proportion of the residential transactions are being made with mortgages and more with by cash buyers.

How these cash buyers behave in the market might be important in smoothing or exaggerating trends. Certainly they appear to have helped prop up sales (proportionately) when prices collapsed.

The questions to ask then are: Has this pool of cash buyers been depleted? Will potential cash buyers hold off in significant numbers if they sniff a further fall in the market and new opportunities to seek out bargains?

Anyway, lots to think about and lots of room for debate. But you can see why the latest figures might be spooking some in the market.