RICS sees workload slump deeper in late 2009 – providing more fare for the double-dippers

It’s tempting to see the latest construction market survey by the surveyors’ body RICS as yet more evidence of a likely double dip in construction – however you want to define that.

And I’m not going to sit here and argue against that possibility.

But there is a case for some cautious reflection before drawing too hard and fast a conclusion from the headline figures from the RICS survey.

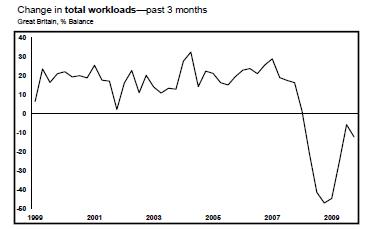

Certainly the total workload figures (see graph right which is taken from the RICS survey) for the final quarter of 2009 suggest a deepening of the pace of recession after what appeared to be a bounce back towards stability over recent quarters.

Certainly the total workload figures (see graph right which is taken from the RICS survey) for the final quarter of 2009 suggest a deepening of the pace of recession after what appeared to be a bounce back towards stability over recent quarters.

The line measures the percentage balance between those seeing more work and those seeing less.

Zero represents no growth and an equal proportion of fallers and gainers.

So the flick downward in the graph does certainly suggest things got worse faster late last year.

But if we look at the sector detail within the overall figures we see that much of the upswing from the first quarter of 2009 was down to a marked slowdown in the pace of decline of private house building activity.

And much of the latest fall in the balance of surveyors seeing more work is also down to the private housing sector where workload fell faster than in the previous three month period.

This we should expect.

The dramatic destocking among house builders in 2008 followed by opening up of new sites in the first half of 2009 will have had an exaggerated “stop-start” effect on the likes of surveyors.

So, a shudder in levels of activity is not unexpected as the house building sector settles to a “new normal”. Next quarter’s figures will be interesting to observe and worrying if they show a continued fall in the measure.

But while the private housing figures can be seen to provide some solace, the slip of the public works sector into negative territory is of concern.

Although it would be silly to take too much notice of one quarter’s figures, given the turbulence in the economy, the RICS survey is a pretty good forward indicator of work on the ground. So this is a strong hint that the slide in public sector work might be heading to construction sites near you soon.

There is naturally the possibility that public bodies might start to anticipate the downturn and switch off the capital spending tap sooner rather than later. And certainly yesterday’s orders figures show a drop in the value of new orders in the second half of 2009 compared with the second half of 2008, if not the volume.

Certainly the RICS points to a slowdown in public spending, and cites caution ahead of the General Election as a possible reason.

Meanwhile the commercial sector remains mired in a slough. And, while the rate of decline has eased, it is hard to imagine what will bring growth to this sector in the near future. But the figures do point to the sector being close to the bottom, which is some comfort.

So it can come as little surprise with all sectors in decline that expectations of an improvement to workloads have faded, although they remain just positive.

But as the history shows, optimism bias is alive and kicking among the RICS survey respondents.