Fewer redundancy in construction, but the future remains bleak on jobs

For the optimists in the construction industry there is much hope to be gleaned from the latest employment figures.

Equally for the pessimists there is plenty within the numbers to fret about.

Equally for the pessimists there is plenty within the numbers to fret about.

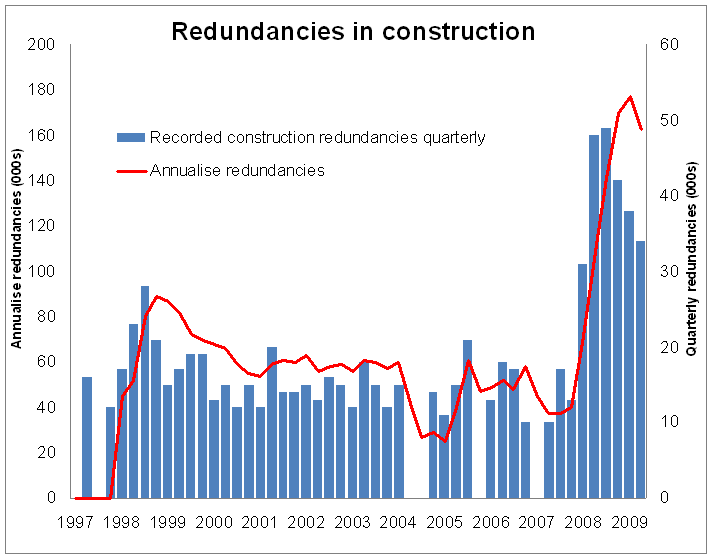

So what should we make of the latest batch of labour market numbers that, among other things, show that 163,000 redundacies were recorded in construction in 2009?

Firstly the good news. The overall number of unemployed fell by 3,000 in the final quarter of 2009. That will be seen as a plus, particularly among house builders who fear a downward spiral in prices and sales if the ranks of the unemployment grow rapidly.

Meanwhile, the figures also show the rate at which construction jobs are being made redundant appears to be slowing, while the vacancy rate has stopped falling.

Recruiters are certainly suggesting that the opportunities to find work are improving as suggested by the latest JobsOutlook survey from the recruitment industry body REC.

And the suggestion from the admittedly small sample of construction firms within the latest Chartered Institute of Personnel and Development (CIPD) quarterly Labour Market Outlook survey is that construction firms are a bit more positive than the average employer in economy as a whole at the moment. That, however, must be treated cautiously given it is set against the far rougher than average patch that the industry has been through.

Anyway, so far so good.

But let’s look at the graph showing the recorded redundancies within construction. There are still hefty numbers of construction folk being rejected from the industry – 163,000 in the year and that’s just the recorded job redundancies.

This is despite the official figures (if you believe them) suggesting an improvement in the level of repair and maintenance work, which mops up far more labour than new work.

And while vacancy rates have stopped falling they are at a very low level, suggesting that few jobs are being created to absorb those workers being made redundant.

More interestingly, it would seem, is that we need to view the employment and unemployment figures differently in this recession than in past recessions.

Short-time working and part-time working are on the increase. So, while the numbers employed may be holding up better than expected and fewer people are being made redundant than the falls in output might suggest, working hours are falling apace.

In the economy as a whole there were 2.6% fewer hours worked in the final quarter of 2009 compared with the final quarter of 2008.

And, as an article in the latest Economic and Labour Market Review shows, underemployment is, to some extent, becoming the new unemployment.

It estimated that in the year to 2009 Q3 there was a 26.4% increase in the numbers of underemployed putting the number at 2.8 million. These are not people choosing to work shorter hours, but those who are keen to work more.

The ELMR article does not break down the figures by industry sector, but there is plenty of evidence to suggest that this phenomenon is highly active within construction.

Certainly the CIPD survey found that the vast majority of new recruits being sought by the construction firms within its sample were for part-time jobs.

While this approach to human resource management of retaining skills is rightly applauded, there is a downside. It makes the labour market yet more fragile if the recession persists.

Broadly, the proportional cost of overhead per person increases with the reduction in hours. This makes each person, theoretically, less productive financially from the employers’ perspective.

Firms may be prepared to carry this cost for a limited period, but if they see no sign of an upturn the likelihood is of a further wave of job cuts. With people working fewer hours and proportionately carrying larger overheads, this (proportionately) increases the numbers of jobs likely to go.

While this all may seem a little grim, looking forward there are other more worrying potential pitfalls for the construction labour market.

The CIPD quarterly survey made plain that the labour market faces a rough few months as the public sector begins in earnest to shed workers.

The suggestion is that the slow pick up in job opportunities in the private sector will be swamped by job cuts in the public sector.

While few construction workers are employed directly in the public sector, about 40% of work is derived from it. So this pattern is likely to be mirrored as public spending is squeezed, with firms working predominantly in the public sector looking hard at staffing levels.

So what are the latest figures telling us?

Well, frankly, both the construction jobs market and the labour market overall remain highly fragile.

2 thoughts on “Fewer redundancy in construction, but the future remains bleak on jobs”

Recession hits all industries and construction is also not an exception. As shown in graph, in mid 2009 itwas on peak but last quarter it was down and I think that is the result of downfall in economy and recession! what do you think??

I currently work in the construction industry and I can honestly say that things seem to be on the up as far as employment goes, but with inflation at 5% the interest rates will have to rise to counter this high inflation rate and that may stall the housing market once again.

Comments are closed.