Reasons to be careful – December’s higher than expected inflation

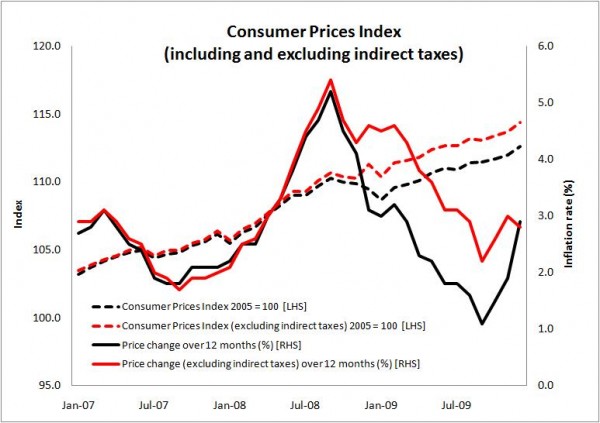

Consumer Price Inflation at 2.9% in December and up from 1.9% a month earlier… mmm… that’s not what the experts expected. Not by a long way.

This morning’s story from Reuters published ahead of the inflation figures had its poll of experts plumping for inflation at 2.6%.

No doubt there will be a lot of post-announcement rationalisation about the figures from economist, but in truth the City and economists at large have consistently underplayed the strength of inflation in their forecasts for some while.

No doubt there will be a lot of post-announcement rationalisation about the figures from economist, but in truth the City and economists at large have consistently underplayed the strength of inflation in their forecasts for some while.

I’ve been a tad dull on this subject for some time. Harping on about the need to maintain an open mind on the likelihood of rising inflation and the possibility of an earlier rise in interest rates than the consensus would have us believe.

And today’s numbers provide me with yet another reason to harp on as they provide further evidence that the consensus among experts may well be underestimating the underlying strength of inflation within the economy.

In September I did some simple sums that showed that from the August figures even if prices stood still inflation would hit 2.5% this month. Then, the Bank of England’s August Inflation Report suggested a central projection that put peak inflation at 2.5% in 2010. And this was pretty much in line with the consensus.

After the release of the October figures when inflation began to rise again, I was concerned at inflation expectations. By then the central projection of the November Bank of England Inflation Report had risen and was pointing to a 3% peak. This again appears to have been an underestimation of inflation, armed as we are now with the latest CPI data.

I can fully understand why there has been a shading on the downside on inflation expectations and I may easily be proved to be well wide of the mark. Inflationary pressures might be less than I fear. They may ease rapidly once the VAT effect and other volatile elements bubbling in the inflation cauldron evaporate. And inflation may then be held more comfortably within the acceptable limits.

The point is not who is right or who is wrong. There is an incredible amount of volatility and we are very much in unchartered waters.

The point is, in my opinion, that we should be more wary about the level of risk associated with holding any particular medium-term view on inflation.

If the consensus among experts is wrong and inflationary pressures are greater than they think, the significance is simple. Interest rate rises will resume sooner than these same experts predict. This could have a big impact on the housing market and a knock on effect on house building.

But it would be wrong to overplay the scale of the December rise too much. While there is clearly room for concern over the figures, there are points to note in favour of why prices were firmer than might have been expected in December.

Firstly, with inventories more tightly controlled the level of discounting will have been less in the end of year sales than a year earlier. Secondly, some firms may have decided to re-price certain goods upward in advance of the rise in VAT, meaning a more muted impact next month. And, thirdly, competition on the high street was reduced with the collapse of big Christmastime players, such as Woolworth.

But equally we would be wrong to underplay a more muted January figure, should it arise. The impact of the bad weather will most likely play its part in queering the data and depressing prices.

Either way, the February Inflation Report and Bank of England Monetary Policy Committee meeting should prove pretty interesting (if you like that sort of thing). While it would be a surprise to see rates rise as a result, it will be worth noting if there is any change in mood among the members and any cracks appearing in the consensus.

That consensus, as expressed in the MPC minutes of the December meeting, is that: “While CPI inflation would most probably continue to rise in the near term, there was a substantial degree of spare capacity in the economy. That was likely to remain a powerful restraint to inflation for some time.”

One thought on “Reasons to be careful – December’s higher than expected inflation”

A year before the GFC, an economist’s report economist’s report on the asset price bubble caught my eye. It suggested that eventually, to rebalance, either asset prices will halve, or else the value of the currency halve to rebalance.

And my immediate thought was hmmmm….wonder which course is politically easier? Duh, no brainer….

The government’s been eagerly debasing the currency in order to prop up asset prices – and consequently Sterling has lost 30% of it’s value on the FX markets.

We’ve had an unique and amazing set of external circumstances holding down UK inflation so far. But with a monsterous wave of pent up inflation poised to crash though the UK economy, it’s only a matter of time before that Tsunami breaks.

Comments are closed.