It’s a long wait yet for commercial construction upswing

Each time a commercial property developer hints at making a move in the market I am confronted with the same question by those with an interest in construction work: Is this the start of the upswing?

This question is usually followed by the suggestion that developers must be keen to build into the recession to place themselves ready for the recovery.

Those desperate to see an upturn around the corner will be pointing excitedly to the Land Securities announcement this week that it will deliver a £655 million West End development programme.

I don’t mean to be a spoilsport, but the answer that always seems to come to hand tends to be a variation on “one swallow doesn’t make a summer”, or some distortion of the Churchillian “beginning of the end, end of the beginning” speech – the emphasis very much on the beginning not the end.

And the latest survey by the surveyors’ body RICS seems to back me up on this. While many of the development indicators are now positive – “confidence”, “demand”, “inquiries” – which is good news, the index for “new development” remains heavily negative.

The reality, unless history is turned on its head, is that we will have some while yet to wait before output in the commercial sector starts to flatten out and begins to rise again.

The reality, unless history is turned on its head, is that we will have some while yet to wait before output in the commercial sector starts to flatten out and begins to rise again.

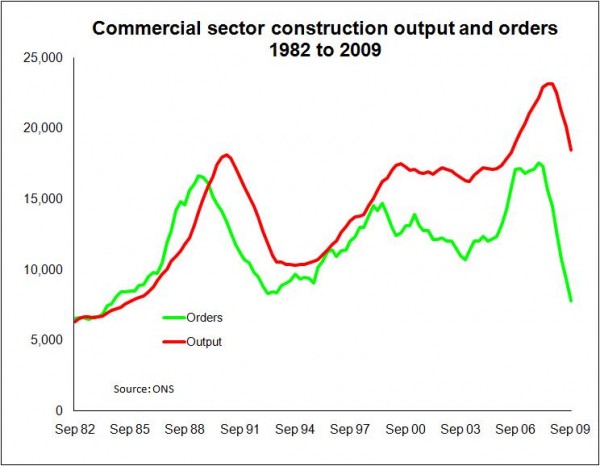

The graph opposite shows a bit of the history of commercial construction orders and commercial construction output over the previous recession. It also shows where we were in the cycle in September last year – very much at the beginning.

As you can see, the previous recession saw output fall for three years from peak and stay flat for a further two years before there was any growth worth mentioning.

The pattern may not follow the history, the recovery could be quicker to come this time. But the graph does rather suggest that we have some way yet to fall and still further to wait before we see meaningful growth.

Fair enough building ahead of the upturn is a sensible plan in theory. But unless the developer has a pot of ready cash they will have to borrow. And there’s the rub. There will be a few who can but most will struggle or fail to get projects off the ground.

Here is a rather sobering comment lifted from a report by Jones Lang Lasalle titled “Lenders’ Expectations”.

Under the heading “Speculative development finance will be unavailable” it says: “Speculative development finance will not be available in the short term as banks’ attitudes to risk are unlikely to change significantly within the next 12 months. Lenders are also concerned about the risk represented by variable income, particularly on turnover leases. We expect many banks to seek to limit the element of turnover rents where they are able.

And as Oliver Gilmartin, RICS senior economist, notes: “The reluctance of banks to lend to developers has clearly added some support to rents in London as available space is no longer rising outside the retail sector. Significantly, development starts continue to fall back.”

Put simply the restraint on cash to build may be providing some good news for the property sector, but sadly not for construction.

The rather more optimistic commercial development report from Savills published last November, points to hunger among developers to get stuck in, but it too noted that “the availability of bank lending remained a concern in the sector”.

So what does it all mean?

Here’s another comment lifted from a property expert. This is taken from the King Sturge Property Predictions for 2010 press conference and is within the presentation by Mark Bourne, joint head of office agency.

“Developers will begin to look beyond the downturn… Speculative starts set for a return particularly in London where shortages of prime space will emerge by 2012. In Central London we may well see occupiers return to pre-letting to satisfy their future requirements.”

And, yes, there will be what statisticians call outliers, such as Land Securities, piling into the development market sooner. But these interventions will be patchy, focused and will account for a small fraction of the work needed to support the sector in the style to which it had become accustomed.

£655 million over three years averages out at £220 million a year. The private commercial construction sector at peak took in £24 billion over a 12 month period.

But one per cent is a start and better than nothing.