Homes sales continued to perk up in April, but it’s too early to call it a recovery

The official figures for property transactions will make comforting reading in April for those selling homes.

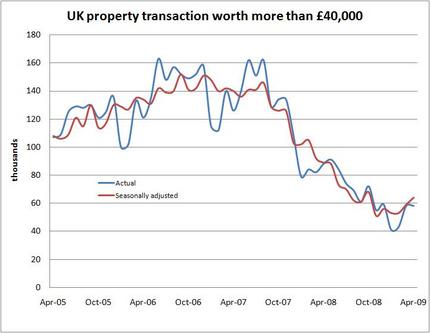

They seem consistent with the prevailing view that the housing market, in terms of sales and not prices, is showing some signs of bouncing back up from the floor reached at the turn of the year.

The latest stats show that in both March and April there were 58,000 deals. This compares with 41,000 in January and 43,000 in February.

It’s worth noting that the March figures published last month appears to have been revised down from 60,000. But as mentioned it is worth looking at March and April together as the impact of Easter varies year to year.

The latest set of figures should calm down some of the rather over optimistic spin being put on the data last month.

That said the April numbers do leave some room for positive thinking in as much as the worst of the nightmare may have passed.

It is, however, rather too big a leap to suggest from the data that we are experiencing a recovery. The drop back in mortgage lending in April as measured by the Council of Mortgage Lenders adds weight to the view that it is too early to call the bounce back in sales a recovery.

The more important point in the numbers, as the graph shows, it is a long way back to the levels to which those in the business of selling homes are accustomed.

In essence the patient is a long way from making a full recovery and there remains a strong likelihood of more complications before the housing market will be fit enough to leave the intensive care unit.